Europe’s biggest neobanks – Revolut, N26, Monzo and Starling – promised to make banking better. Here was a fresh, new set of distinctly European tech startups sitting in the wallets of millions of genuine users – the familiar flash of neon colored cards in pubs, cafes and shops had sparked wildfire word-out-mouth marketing across the U.K. in particular.

From 2014 onwards, the challenger banks offered something simple, better, entirely online and free of the stodgy lineage of century-old banking brands for whom current account banking had become a largely loveless and loss-making exercise.

But the pandemic and the subsequent ‘new normal’ across Europe has pushed neobanks to the edge. With not a penny of profit yet between them, the pandemic was an opportunity for the startups to strengthen their relationship with users, and come out of the lockdown having proved their value over the big banks they sought to disrupt.Recommended For You

This simply didn’t happen. Instead the prospects of the European neobank withered, unused and unloved in the wallets of their users. For years, no one has had reason to question the claim that the bank of the future would be a neobank, but as revenues dwindle, regulatory obligations sap energy and long-serving staff wave goodbye, the basic promise of Europe’s neobanks to deliver on this is fading fast.

Dark Clouds

The first warning came in June when the U.K.’s shining star neobank, Monzo, saw its valuation drop from $2.6 billion in June 2019 to $1.6 billion. The darker clouds of fintech foreboding gathered later in July as poor financial results exposed what they described as “material uncertainties.” While having grown to 4 million accounts, the regulatory responsibilities of running a bank cost time and money, and the pandemic smashed Monzo’s tiny trickle of revenue as the few pence pocketed with every coffee paid for simply dried up at a time when spenders have stayed in, and stayed safe.

Monzo’s founders are fleeing – challenger bank poster boy Tom Blomfield stepped down as CEO in June, while in January this year co-founder Paul Rippon announced on Linkedin that he was stepping down to concentrate on farming his “300 alpacas” with his wife in Northumberland.

Meanwhile Revolut, the only neobank to mint a Forbes billionaire in founder Nikolay Storonsky, is certainly better at putting money in the till than its coral-colored card rival with revenues tripling in a year from $75 million in 2018 to $211 million in 2019 from its wider offering that includes crypto and gold.

But Revolut has a cash burning problem. Staff numbers rising from 633 at the end of 2018 to 2,261 by 2019 is extreme. Its 13 million open accounts puts it miles out front in terms of users, but with costs of $352 million, up from $120 million the year previous, Revolut has simply trebled the size of a loss-making business.

Revolut itself knows this. In a slide from its April Town Hall, Revolut announced to staff that it had lost “operating leverage,” getting “fat and weak” in the process. That same month Revolut launched a company wide voluntary temporary salary sacrifice scheme to retake control. A spokesperson for Revolut told Forbes, “Like many businesses, as revenue reduced, we needed to reduce costs across the business.” While the arrival of $500 million in February in a deal led by California-based TCV, certainly helps, injecting cash straight into the main vein won’t last forever.

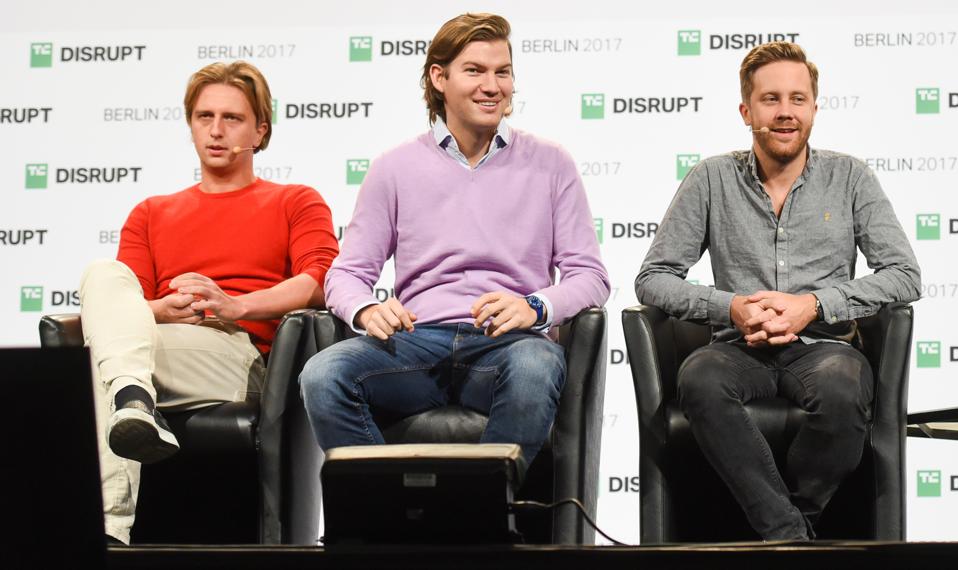

Over in mainland Europe, N26 the German neobank with five million customers, revenue of $50 million and operating losses of $86 million is now licking its wounds over a chaotic row with its staff over soft unionisation (in the form of a more collaborative, workers board) late last week. Reports from Berlin of police being called, and a restraining order filed suggests all is not well.

Founder Valentin Stalf apologized for how the “debate” had “escalated,” after attempting to stop a meeting at a Berlin bar where staff were planning to vote on a Works Council, citing pandemic related health and safety concerns. A staffer told Forbes that this was less about covid expertise and more about union busting having recently claimed that “trust and confidence” in N26 management was “at an all time low.” Stalf denies this, claiming on LinkedIn, N26 was not “trying to stop the formation of a Works Council” and that N26 “fully support” efforts towards stronger representation. A statement described by the staffer as “external PR.”

Neobanks across Europe are simply struggling to adapt to the regulatory and business pressure that comes with their size and ambition, only over in Germany staff feel they’re now the punch-bag pressure release for N26’s banking struggles.

The Starling Darling

As N26, Monzo and Revolut have shared the headlines, Starling Bank, founded by experienced banking chief Anne Boden in January 2014, very much remains the darling of the U.K.’s challenger banks amongst analysts. Sending a clear message to her rivals, Boden wrote last week, “Growth is one thing … we’ve always kept costs under control,” adding that Starling could “break even” by the end of 2020.

The U.K. Government sees something in Starling and its mature, business-like approach to consumers and (revenue generating) business accounts alike saw Starling take on the government’s two lending schemes to support businesses during the pandemic. Starling can claim (in a small way) to be like Dyson and Palantir, a working part of the entrepreneurial infrastructure the U.K. government called on at a time of crisis.

However, despite its prestige, Starling has just 1.25 million customers – a number by itself unlikely to strike fear in the heart of execs at the U.K.’s high street banks. Hard, fast and painful disruption comes when a challenger arrives seemingly overnight offering something cheaper, better and bundled with energy. But having taken six years to hit a million accounts, the incumbent banks across Europe can see Starling slowly lumbering towards them, and presumably have the best part of a decade to reinvent themselves.

Analysis – Bank, Or Lifestyle Choice?

In just six months the tone from analysts and commentators has shifted.

For the experts at Pitchbook, the direction of travel here is clear. Emerging technology analyst Robert Le warns that if a neobank’s sole asset is their “millions” of customers, then they’re only really attractive to a “larger incumbent financial institution” better able to employ the parts of their business that make money. Le predicts a big bank buyout of a neobank in the “near- to mid-term,” sending at least one neobank back under the aegis of the big banks they sought to disrupt.

Accenture’s neobank expert Tom Merry says there’s still a “trust factor” at play here. Six years in and neobanks are really still more a banking bolt-on for millennial pocket money, with deposit amounts in the low hundreds, not thousands of dollars. Whilst the neobanks may hold the key to the customer’s heart through “experience,” Merry says, many customers still see incumbent banks as safer and more secure. Accenture’s Digital Banking Tracker found that the average deposit balance at Neobanks operating in the U.K. dropped by 25%, from $460 (£350) to $340 (£260) per customer across the second half of 2019. Again, the direction of travel here is clear.

With normality slowly returning, the coronavirus pandemic deepened our relationship with the businesses and technology which we came to rely on most.

But lockdown shows the consumer relationship with neobanks is simply not deepening. Standing balance losses aside, if all neobanks disappeared tomorrow, would anyone really miss them?

Source– Forbes

Comment